NEW BANKING POLICIES: Your 2k with Fin-Techs, is it Safe???

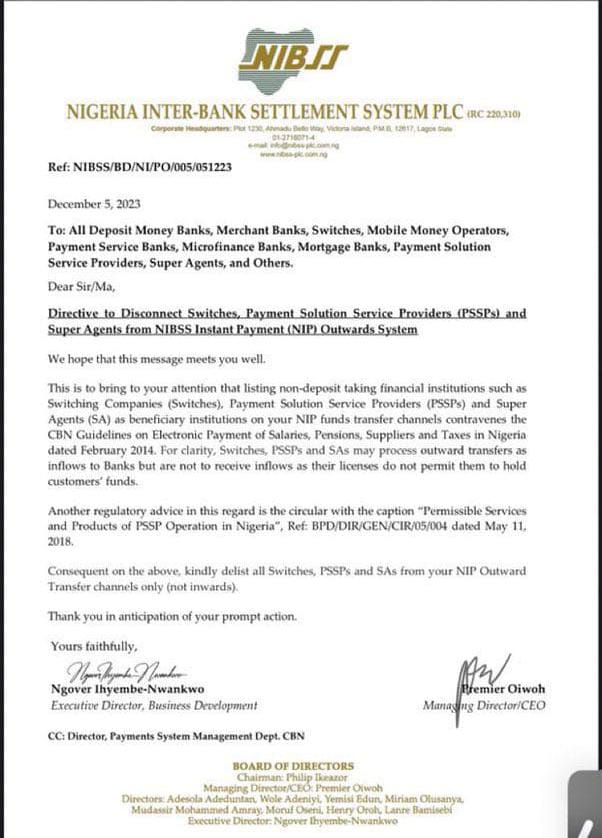

In a surprising move, the Nigeria Inter-Bank Settlement System dropped a bombshell today with a circular titled ‘Permissible Services and Products of PSSP Operation in Nigeria’ (Reference: BPD/DIR/GEN/CIR/05/004 dated May 11, 2018). This has set the online space abuzz with chatter and concern.

So, what’s the buzz all about? Well, it turns out that the wizards handling the money matters in Nigeria—banks, payment companies, and the like—have received a memo instructing them to pump the brakes on some of their services. Let’s break down the commotion in simple terms:

The big instruction is to stop certain types of money movements between different money systems. This affects Switches, Payment Solution Service Providers (PSSPs), and Super Agents in Nigeria. These are the behind-the-scenes players that help money move around quickly.

In a letter to various financial entities like banks, switches, and mobile money operators, it was specified that non-deposit financial institutions (these are financial entities that do not accept deposits from the public) should not be part of the NIBSS Instant Payment (NIP) Outwards System (this system is like a highway for moving money between different places). The reason is that including them contradicts the Central Bank of Nigeria’s rules on electronic payments, as stated in their guidelines.

The letter points out that, though these entities can help send money out from your bank, they can’t accept incoming funds because their licenses don’t permit them to hold customer funds.

This means payment gateways like Flutterwave and Paystack, categorized as PSSPs, shouldn’t be on the NIP outward list because they can’t hold deposits.

The letter also mentions a set of rules from the Central Bank of Nigeria that these companies need to follow. The rules say what services they can and cannot offer. This new change means these companies have to remove themselves from certain money-moving channels.

The twist in the plot? Small business owners are likely to feel the heat, given that they are heavy users of these fintech platforms. But wait, there’s a ray of hope! Fintechs eager to play the deposit-holding game are being nudged to hustle for Mobile Money Operators (MMO) licenses because, according to the CBN, only MMOs get the green light to cradle customer funds.

In a nutshell, the money landscape in Nigeria is undergoing a facelift, and certain companies are tweaking their game plans to dance to the tunes set by the money maestros overseeing the show. The show must go on, albeit with some new rules in the playbook!

AUTHOR: EX-TECHIE

(Content Writer Techblit)

Thanks for the enlightenment

Now clear.

Nawaooo

Thanks for the clarity…

Thanks for the update.